The state of payment options today leaves restaurant merchants with a lot of choices for payment. With so much new technology, it’s not surprising if you have a lot of questions.

What is contactless payment? Is Apple Pay safe? What about Google Pay? What benefits do contactless payment options offer? Here are just a few:

- Quicker transaction times

- No app required

- Safer transactions

- Increased privacy for guests

We are delving into these questions and more to help you navigate the top digital payment companies and digital payment solutions for your restaurant.

Payment options for restaurant customers in 2022

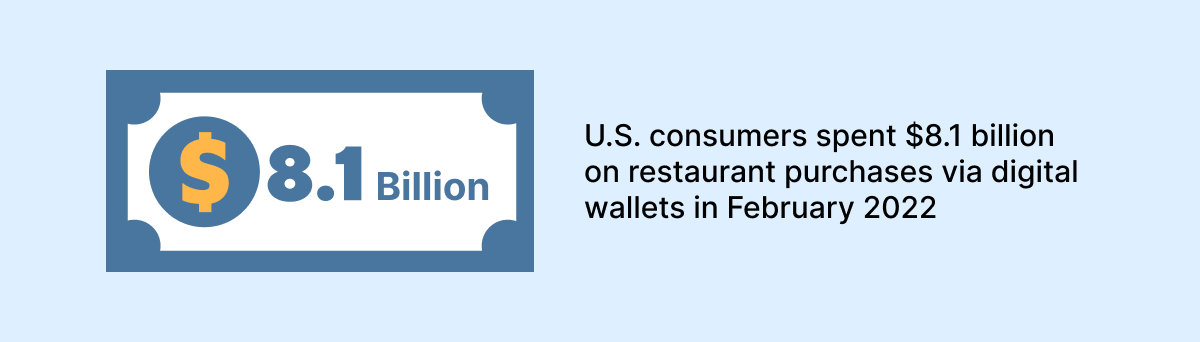

Today, restaurant merchants are faced with multiple options for accepting payments from customers. Traditional card and cash payment options aren’t the only things out there anymore — digital payment solutions are the new popular way to charge.

In addition to cash, card, and check payments, merchants can now choose to accept contactless credit card payments and digital wallet payments. Cash and checks were the traditionally-accepted forms of payment for restaurants. Since not many people carry cash or checks anymore, and they can have a higher risk of fraud, their popularity is waning. Now, popular digital wallet options like Apple Pay, Google Pay, and Samsung Wallet, are becoming the norm.

Each digital payment solution has its pros and cons, but if you choose to integrate one, it makes sense to integrate all of them. The setup for accepting digital payments is fairly simple. And, with most individuals in the U.S. owning smartphones, Android (44% of smartphone users) or an iPhone (55% of smartphone users), it would be to your advantage to accept multiple digital payment options to cover all your bases.

The digital payment technologies available today mean a cashless business is completely possible. Whether you want to go completely cashless or prefer to work with cash only, we’ll talk through the pros and cons of accepting each type of payment.

Cards

Cards are used for the majority of consumer payments, according to a study by the San Francisco Federal Reserve.

And these days, you have additional options for how you use your cards — you can load them into a digital wallet and use contactless payment.

So what exactly is contactless payment? It’s an easy system known as Near-field communication (NFC); it communicates with your bank and gathers your info to check out.

Mobile wallet options from top digital payment companies include Apple Pay, Samsung Wallet, or Google Pay, and help guests to pay digitally. But since all of this links to your break, are programs like Apple Pay actually safe? Let’s investigate.

What is digital payment?

The cooler, breezier younger sister of the credit card just arrived, and it’s digital payment. This type of payment allows customers to pay contactlessly using their smartphones. No need for customers to search for the right card in their wallet or swipe it just right on a pesky card reader — with a contactless payment app, customers simply have to hold their phone close to the machine, and boom, payment done.

Digital payments work with a merchant’s NFC terminal - like a handheld, POS, or card reader - to make a payment. NFC technology creates a very short-range wireless network that only works within a range of a few centimeters or less. Data can then be transferred between two devices on the network.

The data transferred is encrypted, meaning it’s transferred using a code. This way, the guest doesn’t share an actual credit card number with a retailer when they pay, so customers rest a little easier when they use this digital wallet service, and merchants worry less about keeping payment info secure.

Customers may use a few different options to hold their mobile wallets, but the setup for merchants is fairly simple for any of the options. The three most popular options are Apple Pay, Google Pay, and Samsung Wallet.

Apple Pay

Premiering in 2014, Apple Pay is a popular mobile wallet option. The payment method allows individuals to upload pre-existing credit, debit, or prepaid cards to their wallet on their iPhone, Apple Watch, iPad, or Mac computer — no app download required.

Payments can be made online, or in participating retail locations. And there are no extra fees to process payments. Merchants are only responsible for the standard credit card processing fees.

It’s also quick! All customers need to do in order to complete a payment is scan their face on their phone and tap. Face scanning can be done while you're wearing a mask, a hat or even sunglasses.

The only component of Apple Pay that some disapprove of — it’s only available to Apple users.

Google Pay

Birthed from a merger of Google Wallet and Android Pay in 2015, Google Pay is another contactless payment app. Users can download the Google Pay app and upload their card information to the wallet to use it. It’s available to both Android and iOS users to make payments online or at participating retail locations.

Just like the other digital wallet options, it’s safer than pulling out your actual credit card to pay. Your information is encrypted when you pay which reduces the risk of credit card fraud.

Samsung Wallet

Originally called Samsung Pay, the company has now upgraded and rebranded to Samsung Wallet. It includes features such as health history management, digital keys, digital asset management, and digital payment through the Samsung Pay component.

Is Samsung Pay safe? You can rest easy. Samsung Wallet works just like Apple Pay or Google Pay, so it’s actually safer than paying with a regular credit card. But it’s only compatible with Samsung devices where it comes already installed.

Show me the money

So, is Apple Pay Safe? Based on encryption tech and encoded credit card numbers, that’s a big yes. How can merchants take advantage of new payment technologies? You don’t want to overwhelm yourself or throw out old payment types completely, but expanding your options is a win for merchants and guests.

While setup for accepting digital wallet payments may mean some extra work for you on the back end, it can pay off quickly for your business. Picking the easiest and fastest payment options can help cut down on transaction times. Going cashless can even streamline your process and make transactions clean, simple, and safe. With digital ordering options becoming more popular, guests are already using scan-to-pay tech in their everyday lives.

However, if a lot of your customers are older and still use personal checks, you may want to keep using what you know works. Opting to go cash-only is how low-profit-margin venues dodge credit card processing fees, and some even offer a discount on their menu to anyone paying with cash.

At the end of the day, you want guests to pay you. You don’t want to make things too complicated for your staff by springing a thousand new gadgets on them at once. But if you notice you have to turn away customers regularly due to the payment types you accept, you may want to reconsider. Lean into digital payment tech to make life easier for you, your staff, and your guests, while adding a few extra dollars to your bottom line.